Updated January 2024

Picture this: You’re scrolling through your Instagram feed, and every other post is a pixel-perfect snapshot of someone trekking through the Amazon rainforest or shopping in Tokyo.

And there you are, dragging your feet on your way to work, calculating the months you’d need to save to afford such an escape.

From plane tickets to lodging to transportation, it can seem almost impossible to save money for travel because things can get so expensive.

If you’re anything like me, traveling is a top priority for you. You like to shake things up and see what the world has to offer.

But what if you don’t have a lot of money for your dream vacation?

What if things are tight right now, and you have to postpone your trip for yet another year? 😫

Well, now you won’t have to!

Saving money for travel isn’t just a vague aspiration—it’s a concrete, attainable goal.

Here are 10 tips you need to not just dream of far-off places, but to actually get there. And they’re not as hard as you think.

So, dust off that old suitcase, buy some sunscreen, and get ready for your next excursion!

👉 Btw, the tenth tip is an absolute game changer!

Some of the links in this post are affiliate links. This means if you click on the link and purchase the product or service, I will receive a small commission at no extra cost to you. Click here to learn more.

The Art of the Travel Fund: Your Gateway to Adventure

Are you sitting there, the travel itch almost physical, but the cost a worry?

As much as travel guides harp on about exploring “on a shoestring”, you need to have money saved up to appreciate your trip fully.

Your future self will thank you when you’re sipping sangria in Spain, carefree because your finances are sorted.

Let’s delve into wallet-friendly wisdom and discover how millennial women can turn their travel desires into reality.

1. Add an Extra Income Source

This one may come as a no-brainer to some, but adding another income source to is a fantastic way to make some extra money for travel.

If you have a few free hours on the weekend or a little time after work to add on a side hustle or part-time job, you’ll get to your savings goal quicker.

I know a second job does not look too enticing, especially if you’re already working full time and are tired after the long workday, but remember it’s only temporary.

I’d recommend finding a remote job so you can earn money from the comfort of your own home.

As a result, you’ll also save money on gas because you’re not driving to your next job.

Recommended Job Sites

If you’re looking for steady work, I’d recommend Indeed. That’s the website I use for 80% of my job searches.

Another option for finding working is by using LinkedIn. This professional networking site posts hundreds of jobs each day.

All you have to do is create an account, complete your profile, and start applying.

Alternative Ways to Work

If you want to make additional income for only 3-6 months, consider going through temp agencies or freelancing.

If you have a profitable skill, such as coding or web design, you could advertise your expertise on Fiverr or Upwork.

While it may take a few weeks to get traction from those sites, you’re using the skills that you already have, and won’t have to go through an onboarding phase like you would with a regular job.

Additionally, websites like Skillshare offer on-demand learning for virtually any skill you wish to master.

Click here to start your free 1 month trial of Skillshare!

2. Stash Your Bills

This is such an easy (and somewhat fun) way to save money for travel!

I know many people don’t carry cash on them these days, but we have a few bills in our wallets every now and then.

So, here’s what I need you to do.

First, look around your house/apartment and find either a shoebox, one of those big ol’ mason jars (we’re millennials, you know we keep a good mason jar).

Even a large manilla envelope would work.

Then, once you have one of those things in your possession, make a habit of putting any bills that you come across into it.

You’ll be surprised at how quickly your bill stash could grow, and by the time your trip comes around, you can use that money!

This method works well if you’re a visual or physical touch kinda person because it’ll feel more “real” to you.

3. Learn Where Your Money’s Going

This is an essential tip to saving money for your next vacation.

You absolutely, without a doubt, HAVE TO KNOW WHERE YOUR MONEY IS GOING.

For instance, if you get paid on the first of the month and by the time the 30th rolls around and you’re not sure where your money went, you will have a lot of trouble growing your travel fund.

I can’t stress enough how important having a budget is.

Ideally, you’d want to know:

– How much your monthly expenses are (rent, utilities, etc.)

– The amount you’re spending on food (it quickly adds up)

– How much you’re spending on personal pleasures (outings, shopping)

If you have a budget in place, you’ll can see where you need to cut back on expenses.

For example, if you have a Hulu AND Netflix subscription, determine which one you spend more time on, then cancel the other.

Next, put that extra money into your travel fund each month instead.

Again, it may not seem like a lot now, but it adds up quickly!

If you eat out four times a week, try to scale back to twice a week.

Cook some meals at home, and then put that extra money from the other two days towards your travel fund.

There are many ways you can get creative with your budget just by tweaking some things and making a couple of sacrifices.

By the time your trip approaches, you’ll more than likely keep doing these things because they’ve become a habit now, and you can keep putting that money into your next savings goal.

4. Sell Your Stuff

How many of us have things we bought ages ago but no longer use, want, or need?

If you want to save money for travel, consider selling some of your stuff.

If you’re holding onto a guitar you bought four years ago in hopes of learning how to play one day, it’s time to let it go and get some money back for your purchase.

Take inventory of all the things you have (big and small, old and new), then determine the items’ condition and the last time you used them.

Once you decide what you no longer want and what you think you could sell, post them on websites like eBay, Facebook Marketplace, and Craigslist.

**Be really careful with sites like the ones mentioned above, especially if you’re meeting with a buyer to make the sale.*

Tips for meeting with a buyer:

– Never meet in a sketchy area. Instead, meet in well-lit, public places

– Ideally, bring someone with you when you’re meeting a buyer

– Let your family and friends know where you are

– Always bring two receipts with you for the buyer to sign (one for your records and one for theirs)

– Bring pepper spray or another small self-defense weapon; just in case (better safe than sorry)

*You can also hold a yard sale to cut out the hassle of driving to meet with a buyer.*

It feels good to de-clutter and make money in the process.

Things you could sell:

– Furniture

– Kitchen appliances

– Unused musical instruments

– Old video games/consoles

– Clothes/gently worn shoes

– School textbooks

– Electronics (cameras, phones, TVs)

If you’re enjoying this post so far, subscribe below to my email list. You’ll get relevant posts like this one, as well as Subscriber Exclusives!

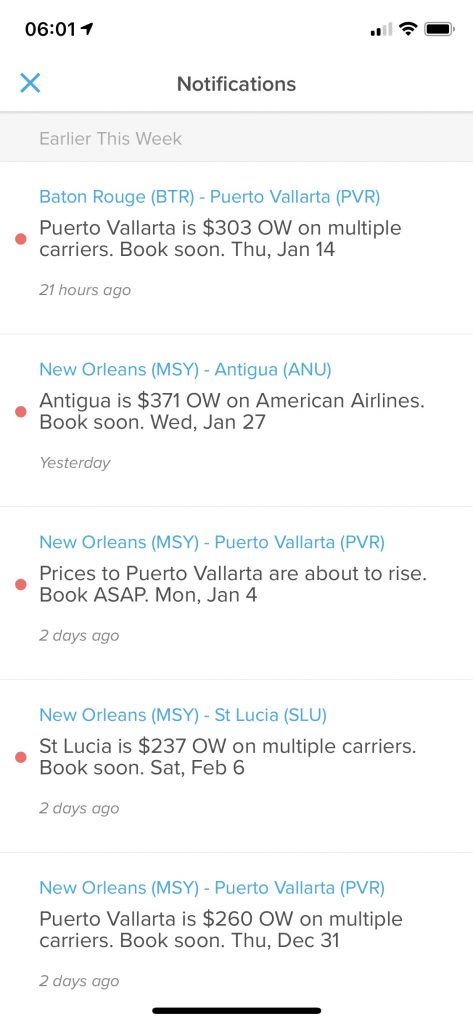

6. Look Out for Flight Deals

If you’re trying to save up for your next trip, try checking out websites that compare hundreds of flights each day.

This is a great way to see which ones have the best deals.

I use these websites to check prices: Google Flights, Hopper, Skyscanner, and Momondo, Going (formerly Scott’s Cheap Flights).

I get alerts sent to my phone whenever prices increase or decrease.

While I’ve never directly booked through one of the sites, if I go to the carrier’s website, the price is still the same. 😎

6. Cut Out Bad & Expensive Habits

Now, I’m not trying to tell you how to live your life…

But if you have bad (and usually expensive) habits, consider cutting them out if you want to save money for travel.

For example, let’s say you’re a smoker who smokes a pack a day. Considering each pack is around $6, you’re spending well over $2000 each year!

That’s A LOT of money to be going towards something that’s taking years off of your life.

Maybe you have other habits that are costing you.

Like gambling, excessive alcohol drinking, or buying coffee every morning before work when you have a coffee maker at home.

All of these things quickly add up.

Take a look at your life and see if there are any bad habits you can quit to reach your travel fund goal sooner.

Keep in mind that the not-so-great habits will most likely be hard to break, so don’t be too hard on yourself.

7. Automate Your Savings

First things first, make saving automatic. It’s like setting up an invisible travel jar that the bank fills up for you. Here’s how it works:

Set up Automatic Transfers

For me, saving was a game-changer when I scheduled bi-weekly transfers from my checking to my savings account.

It’s surprising how you adapt to “not seeing” that money, and lo-and-behold, it adds up!

Savings Apps and Tools

Explore apps like Goodbudget that analyze your spending and save a little from each check, or get old school with a DIY excel sheet to track your progress.

Whip Out a Separate Travel Savings Account

This is the piggy bank of the digital age. One glance at that growing balance would be enough to curb any impulse buys that threaten your dream travel fund.

I recommend looking into a high-yield savings account so your money can potentially grow faster.

8. Have “No Spend” Weeks

Here, the name is the game. Commit to a week where you minimize any expenses outside of necessities.

Sounds daunting? It’s simpler than it seems!

Get in the No-Spend Mindset

Carpool, bike, or simply walk—a week with minimal fuel expenses does wonders for your savings. Plus, meal planning with low-cost, high-nutrient foods ensures your belly and your bank account are satisfied.

DIY and Stick to It

Create a fun list of free activities in your area, or plan movie nights in with friends. With a little creativity, you can you tackle your boredom without spending a dime!

9. Use Travel Reward Programs

Reward programs sound like a pipe dream, but they’re not.

Turn your daily purchases into points—the more you shop, the closer you are to a flight to your dream destination.

Maximize Point Collection

Sign up for all the programs: airlines, credit cards, even those quaint little local coffee shop loyalty cards. Every bit adds up!

Stay Ahead with Perks

Research merchants and cards that give the highest rewards for stuff you already buy. It’s about strategic splurging—an investment for future savings.

10. Save While On Vacation

Once you’ve saved up and you’re en route to your trip, that doesn’t mean you throw caution to the wind, or worse, your budget. Learn to save while traveling:

House-Sitting: A Traveler’s Triple Whammy

House-sitting has single-handedly saved me THOUSANDS of dollars over the last couple of year.

Not only could you stay in a fantastic home for free, but you’ll have a “home base” to explore from, and a cute pet to keep you company.

I’m a member of TrustedHousesitters, and I honestly couldn’t recommend this company enough.

They make it so easy to find free homes (all over the world 🌍) in exchange for taking care of the homeowner’s pet(s)!

Ready to get started with house-sitting?

Join TrustedHousesitters to get a 25% discount – use code MARSZ25

Opt for Off-peak Travel

Your flexibility will pay off big time. Traveling during non-peak times means lower flights and accommodations, which means lesser crowds and better photos!

‘Home’ Cooked Comforts

Your lodging’s kitchen is your ticket to savings. Cook your meals with local ingredients that you buy at the grocery store.

It’s not just budget-friendly; it’s a delicious cultural immersion!

You can even take it a step further by making use of the destination’s public transportation system instead of using rental cars or ride share apps.

Ready, Set, Save: A Millennial Woman’s Path to Adventure

By now, these tactics should sound more like realistic strategies and less like restrictive rules.

Remind yourself constantly why you’re doing this. That mountain sunrise in Machu Picchu or the Parisian view from the Eiffel Tower is worth it.

And remember, the best time to save for your next adventure is now.

So, implement these tips, embark on your saving journey, and watch as your travel dreams evolve into an exhilarating reality.

CLICK HERE before you plan your next international trip!

Peace, love, and good vibrations.