Does any other millennial get stressed out when they hear the word “finances“? With so many people living on a budget, trying to save money, looking for ways to invest, or figuring out how to pay off debt, it’s no surprise that ANYTHING relating to currency can sometimes make a person feel uneasy.

Money used to control my life (in the worst way), and I’ve learned how to manage it WAY BETTER than I did a few years ago. If you feel like your finances are spiraling out of control, and you’d like to learn five solid money management tips, this post is for you!

Bear in mind that I’m not a professional financial advisor, but I’ve incorporated these tips into my life, and they’ve helped me tremendously. Please do what you feel is best for your financial situation.

***Some of the links in this post are affiliate links. This means if you click on the link and purchase the product or service, I will receive a small commission at no extra cost to you. All opinions remain my own. Click here to learn more.

1. Group Your Different Expenses

First things first. Let’s determine where your money has to go each month. Are you paying rent? A mortgage? Do you have childcare expenses? Debt repayments?

There are many categories that your hard-earned money can be put into, so it’s best to organize the different categories under “money umbrellas.”

I’ve come up with four umbrellas that typically cover most expenses, and I’ll be referencing them throughout this post.

Umbrella #1 – Needs

This category is for your necessities. I’m talking about your NON-NEGOTIABLES; things that you need to survive daily, both in your personal and work life.

This umbrella usually contains expenses for:

– Housing (mortgage/rent and any insurances associated with that)

– Groceries/essential items

– Transportation (personal or public; gas; car payments/insurance)

– Utilities (lights, gas, water)

– Insurance (life/health)

– Child care or other family care you may pay for

– Entrepreneurial tools (email provider, editing software, etc.)

– Phone

– Minimum loan payments (Anything beyond the minimum can go into the debt repayment umbrella mentioned later)

***Keep in mind that what I consider a need may be different for you, which is completely fine. Take account of everything that you’d consider a necessity.

Umbrella #2 – Wants

Your wants are things that you don’t NEED, but you would surely love to have it/do it. One of my biggest “wants” is getting weekly takeout. (Anyone else not really into cooking? DoorDash me, please and thank you!).

What are some wants that you’d like to include in your budget? New shoes? A new phone?

This umbrella usually contains expenses for:

– Monthly subscriptions, like Netflix or Amazon Prime

– Entertainment

– Meals out

– Shopping

***Click here to grab your free Wants Vs. Needs download. It’ll help you determine your necessities over the things you would like to have.

Umbrella #3 – Savings

The next umbrella is your savings. Your savings should act as a buffer, so you don’t have to spend your monthly income on certain expenses, like an emergency that comes up or a vacation that you’re planning.

This umbrella usually contains expenses for:

– An emergency fund

– Saving for retirement through a 401(k) plan and perhaps an individual retirement account

– College funds

– Travel

Umbrella #4 – Debt

Last but not least is the Debt Umbrella, a.k.a. The Devil’s Fund, as I sometimes call it.

Debt sucks. It really does. If you’re someone with debt, I know you share my sentiment.

However, it’s still an umbrella that needs to be included in your monthly budget. Regardless of how far you are in your debt repayment, know that the light’s at the end of the tunnel!

Make it a priority each month, and you’ll soon see your monthly debt payments decrease.

This umbrella usually contains expenses for:

– Paying off debt (preferably the high-interest debt first) in the form of credit card debt, student loans, payday loans, etc.

Sidenote: If you don’t have any debt, you can turn this umbrella into investments, charities, additional savings, etc.

2. Pay Yourself First

Now that we’ve gotten our money umbrellas out of the way, we’re onto the second financial tip, which is ensuring you aren’t shortchanging yourself every payday. I was a huge culprit of this practice.

I can’t tell you how many times I’ve paid all of my bills for the month and bought (read as “overspent”) on groceries, only to realize that I had maybe 30 bucks to last me the next two weeks.

God forbid there was an emergency because I would not have had the funds to pay for it (which was how I landed in credit card debt years ago).

It’s SO IMPORTANT that you PAY YOURSELF before doing anything else with your money! I know this can sound so counterproductive, especially if you aren’t making too much money right now and if it seems like you have bills knocking on your door every other day.

Just trust me on this.

It doesn’t have to be an extraordinary amount that you give yourself each time you get paid, but just enough to “put in your pocket,” as my late grandmother used to say, in case you need it for a rainy day. Think of your “pocket money” as a super small emergency fund.

When I started paying myself first, I’d allocate my money to two places:

1. My savings account

2. My wallet (because I know had I left it in my checking account, I would have spent it on something I didn’t REALLY need)

I remember times when I could only afford to put $20 in my savings account and give myself $50, but hey, it was something!

Maybe you can afford to pay yourself more than that, or perhaps you have to pay yourself less for a couple of months. Either way, it’s okay!

Additionally, another option you have is automatically paying yourself a percentage out of each paycheck to make things easier. With this method, you won’t even have a chance to miss the money coming out of your paycheck!

Chime has an excellent system in place where you can automatically pay yourself 10% of every direct deposit if you have yours set up through their company (and it’s free!).

To get started with Chime today, click here.

In paying yourself first, you’re subconsciously putting yourself and your wellbeing first, which I think is one of the best things you can do.

It can be easy to neglect ourselves if we have a lot going on and so many things to pay for. No matter how difficult it may be for you to pay yourself first and not think about what bill or debt you could be contributing to, remember that YOU MATTER FIRST!

Ultimately, ensuring that you are taken care of (even in the smallest of ways) can do SO MUCH for your mindset and self-worth.

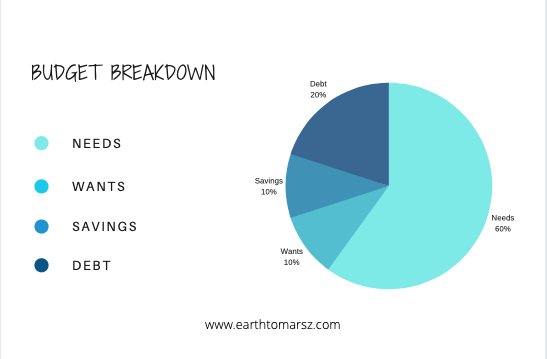

3. Group Your Income Into Percentages

Once you’ve determined your money umbrellas and after you’ve paid yourself, you’ll then want to group your monthly expenses into percentages.

However, I understand that everyone’s finances and priorities are different, so feel free to make any changes to these percentages as you see fit.

60% – Needs

10% – Wants

10% – Savings

20% – Debt

Let’s say you make $700 every two weeks, so you’re working with $1400 each month.

You save 10% of each paycheck, which totals $140 to pay to yourself.

This means you have $1260 that need to go into your monthly budget percentages.

So let’s take a look at how this plays out.

Needs – [1260 x .60] = $756 to spend

Wants – [1260 x .10] = $126 to spend

Savings – [1260 x .10] = $126 to save

Debt – [1260 x .20] = $252 to repay

See how manageable this is. You know exactly how much money should go into each percentage for the entire month.

So to recap, you’ll want to:

1. First, figure out your money umbrellas

2. Then determine how much you make each month (I know for freelancers and other entrepreneurs, it may not be a set amount but give your best estimate)

3. Next, pay yourself first and deduct that from your income

4. Finally, calculate your remaining income into your budget percentages

You’ve got this! Make any adjustments if you need to, and don’t be too hard on yourself. It can take some time for you to perfect which percentages work best for you.

***To get more relevant posts like this one and other great content sent to your inbox, be sure to subscribe to my email list below!

4. Track Your Expenses

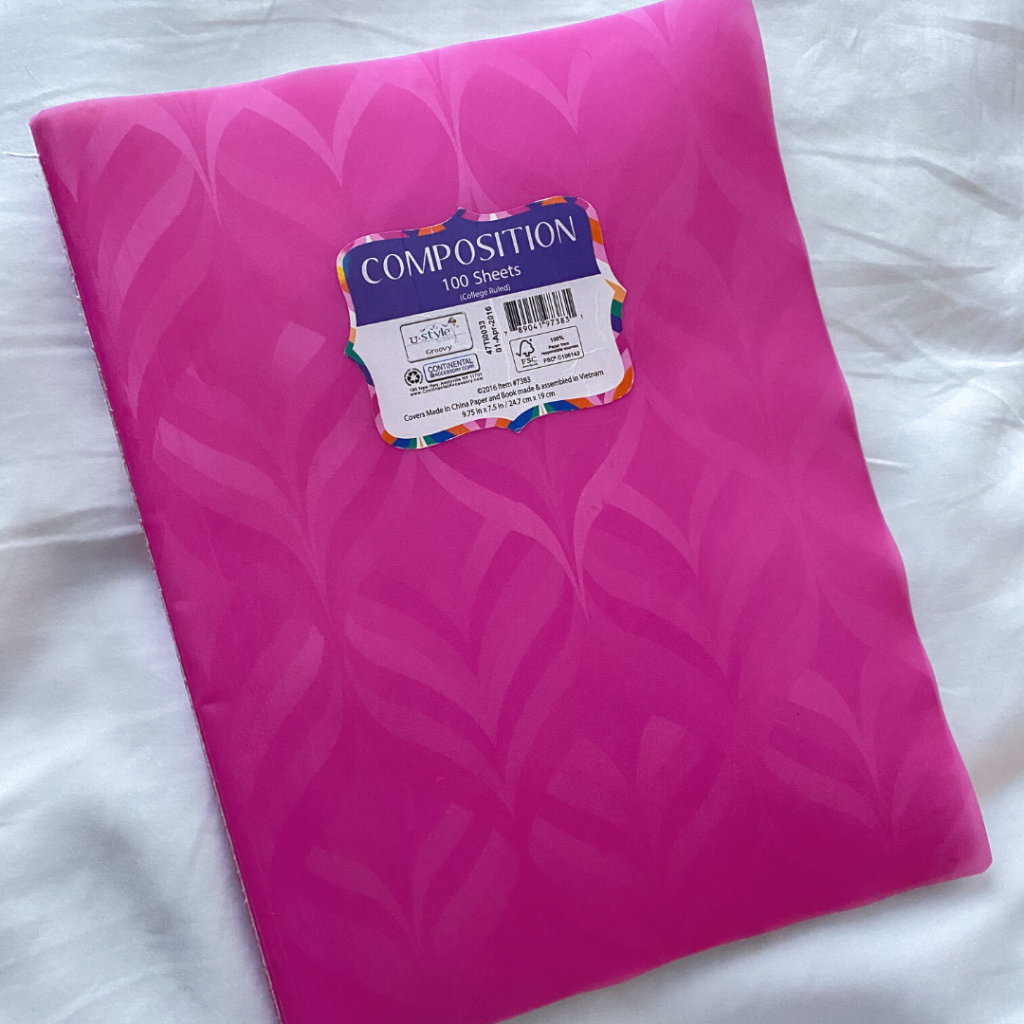

I recommend tracking all of your expenses in a designated notebook or a Google spreadsheet every week and then crossing them out as you pay something.

This way, you’ll know when your due dates are coming up from each company and the amount you need to pay.

I’ve been using the same little pink budget notebook since 2016, and I can’t put into words how much it’s helped me stay organized and on top of things.

I also recommend weekly tracking because you’ll be able to gauge if you’ll need to make any adjustments to your entire monthly budget down the line.

Let’s say you have an expense that only happens four times a year, but it’s a significant expense that you’ll need a little more time to prep for.

In knowing this, you may need to tweak your budget for the next few weeks to ensure you’ll have the funds allocated to cover this significant expense.

Staying ahead of things will help set you up for financial success!

***Click here to grab my Monthly Budget printout to help track expenses!

5. Envelope System

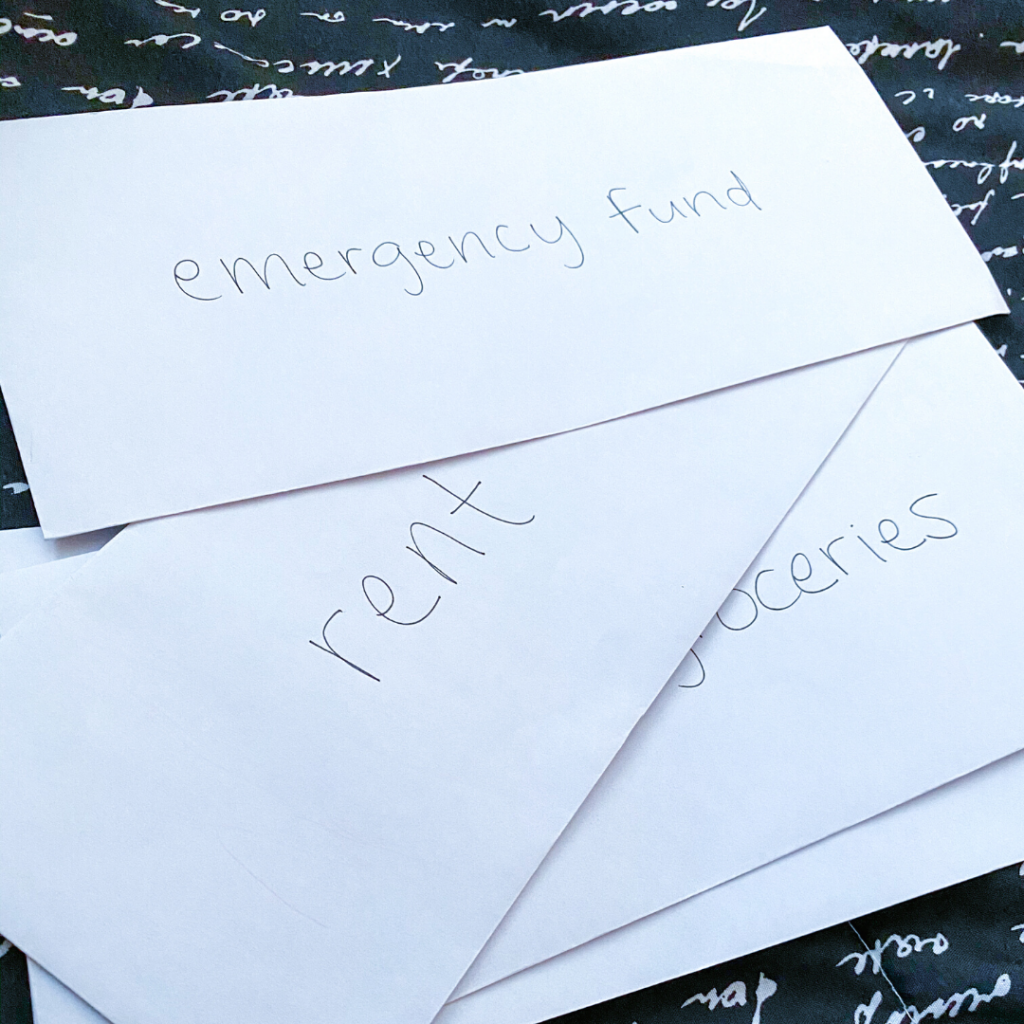

How could I talk about money management and budgeting without mentioning the Envelope System?

Popularized by financial expert Dave Ramsey, this system ensures you stick with your budget because you place your allotted income into various envelopes (determined by your money umbrellas).

Then, once an envelope is empty, you can’t spend any more from that category.

I’ve done this system in the past, and it forced me to buckle down on my finances.

If you haven’t tried the Envelope System yet, I recommend it. I know that it’s not for everyone, and you may be tempted to dip out of one of your envelopes to help fund another category (I’m a culprit, yet again).

Still, it teaches you discipline and strategic money allocation, which are some of the TOP things you’ll need to get your finances in order.

Millennial money management takes time, but it is doable. Once you have a system in place, that’s half of the battle already won.

Leave a comment down below on different money tips that have helped you out in the past!

Peace, love, and good vibrations.